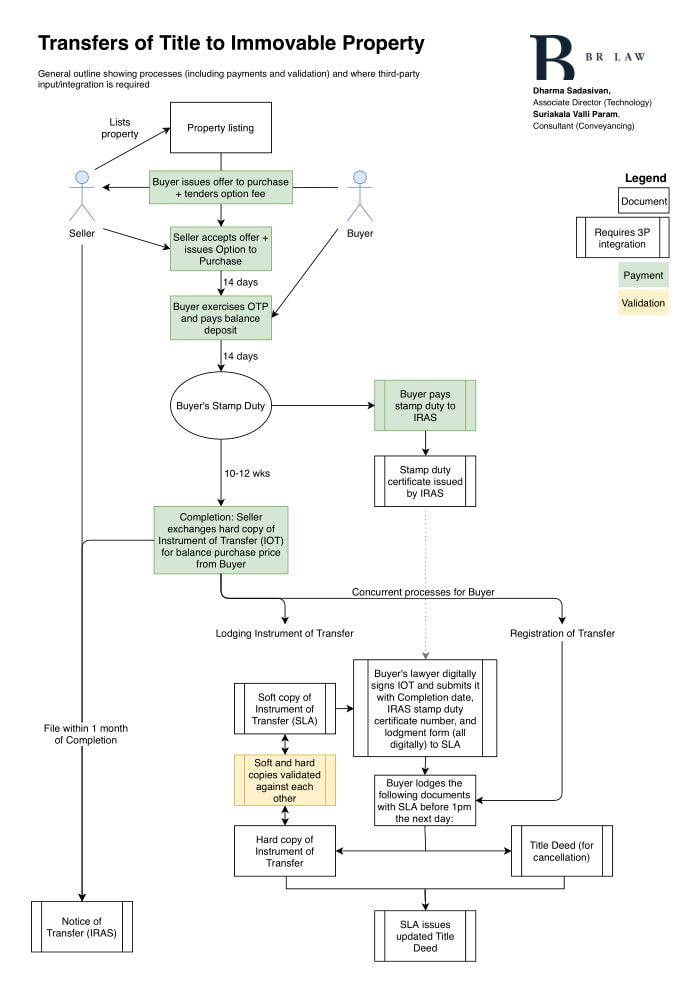

03 June 2019Dharma SadasivanAmong the many possibilities that blockchain technology presents, there are few as exciting, promising, and perhaps even fashionable, as the use of the blockchain to facilitate transfer of title to immovable property (real estate). The blockchain affords many advantages – for countries that do not use the Torrens system, a fraud or tamper-proof, auditable ledger that records every transaction would be an ideal way of digitizing title deeds, leases, and encumbrances. It promises faster and cheaper property transactions with far reduced paperwork. It could potentially allow automated testamentary transfers of property pursuant to wills. Tokenizing real estate would lower the barrier-to-entry for property ownership, giving lower income families the opportunity to purchase, own, and invest in property – an opportunity from which they may otherwise be precluded. There are many models and frameworks that have been developed, particularly in the start-up space, for how the blockchain can be used to facilitate real estate transfers – yet, many of them lack the critical ingredient in making it workable – State-level integration. No matter what app you build, if your country's land title regulator does not recognize a title transfer under your app, there is no title transfer under law. In this article, we look at how real estate transfers in Singapore are effected, and highlight various points in the process that would require State-level integration with Singapore's regulatory authorities for the successful digitization and/or blockchainization of real estate transfers. This article does not consider securities regulation and token issuances in relation to real estate. Here is a flowchart of the simplest possible process to effect a transfer of landed real estate. This flowchart assumes that there are no encumbrances on the property – i.e. there are no mortgages, Central Provident Fund ("CPF")* charges, or any other types of claims against the property. The first thing that stands out is that even the simplest possible real estate transfer is in fact rather complex.

Secondly, there are several documents required: an offer to purchase, an option to purchase, hard and soft copies of the instrument of transfer, a stamp duty certificate, the Title Deed (for cancellation), a new Title Deed reflecting the name(s) of the new owner(s) and a notice of transfer to Inland Revenue Authority of Singapore ("IRAS") Property Tax Department. These documents need to be digitized so that they can be appended to a blockchain to record the various transactions. Thirdly, the process requires payment of stamp duty to IRAS, filing of a notice of transfer to IRAS, and various filings to the Singapore Land Authority ("SLA"). The SLA is also the statutory board that registers the change of ownership and issues a new Title Deed in respect of the property. In other words, to digitize the real estate transfer process using the blockchain, you need to integrate these tax and administrative processes with IRAS and SLA. Finally, there is an existing validation process in which the SLA validates the contents of the soft copy of the Instrument of Transfer (an online portion of the process) against the hard copy of the Instrument of Transfer (an offline portion of the process). Therefore, an alternative validation method will need to be developed in order to remove the offline portion and digitize the validation process completely. In more complex real estate transfers involving mortgages, charges, and other encumbrances, further integrations may be required, such as integrations with banks and the CPF Board. If the property concerned is a Housing and Development Board (“HDB”) property then additional integrations with the HDB will be required. While this flowchart applies only to transfers of landed real estate in Singapore, it is likely that other jurisdictions will have similar or analogous processes. The aforementioned State-level integration issues remain likely to be the key barriers for blockchainization in real estate. We look forward to further developments in both the blockchain and real estate, as well as working closely with regulators and disruptors in this space to help transform how real estate transactions are conducted. *Note: The Central Provident Fund is a compulsory employment-based superannuation fund for Singaporeans, administered by the Central Provident Fund Board – a statutory board that operates under Singapore's Ministry of Manpower. Dharma Sadasivan Associate Director, BR Law Corporation [email protected] With thanks and gratitude to my colleague Mrs Suriakala Valli Param, Consultant, Conveyancing, for her kind guidance and input. Post date. Edit this to change the date post was posted. Does not show up on published site. 3/6/2019 |

We're Here To HelpOur team welcome any comments or questions and will gladly assist you with your enquiry. You can call us on +65 6899 9888 or fill out our simple contact form. DisclaimerThe materials in these articles have been prepared for general informational purposes only and are not legal advice or a substitute for legal counsel. If you require legal advice for your particular circumstances, please consult a suitably qualified legal counsel. This information is not intended to create, and receipt of it does not constitute, an attorney-client relationship. You should not rely or act upon this information without seeking professional counsel. Whilst we endeavour to ensure that the information in these articles is correct, no warranty, express or implied, is given as to its accuracy and we do not accept any liability for error or omission. The authors of the articles are or were employees of BR Law Corporation at the time of publication, but may no longer be, now or in the future, in the employ of the firm. Subscribe to our NewsletterSubscribe to our quarterly newsetter to keep up to date with a wealth of insights from the BR Law, BR Family Assets and BR Corporate services team.

Categories

All

Archives

May 2024

|

BR Law Corporation

[email protected]

+65 6899 9888

Firm Brochure |

Practice AreasSubscribe to our quarterly newsletter to keep up to date with a wealth of insights from the BR Law.

|

Contact Us[email protected] Main Branch - Republic Plaza 9 Raffles Place #08-03 Republic Plaza Singapore 048619 +65 6388 1717 Telephone +65 6394 7398 Fax Branch Office - Bank of China 4 Battery Road #29-00 Bank of China Singapore 049908 +65 6899 9888 Telephone +65 6338 5377 Fax Branch Office - United Square 101 Thomson Road #26-02/04 United Square Singapore 307591 +65 6336 1717 Telephone +65 6394 7318 Fax |

Terms of Use • Privacy Statement

© Copyright 2018 BR Law Corporation. Registered in Singapore (UEN: 200312051N).

© Copyright 2018 BR Law Corporation. Registered in Singapore (UEN: 200312051N).

RSS Feed

RSS Feed

Leave a Reply.